When the Business Crumbled: How I Protected My Future with Smarter Assets

What happens when your business suddenly fails? I never thought I’d face that reality—until I did. The collapse didn’t just hurt emotionally; it nearly wiped out everything I’d built. The dream I had nurtured for over a decade unraveled in less than a year. One day, I was signing contracts and planning expansion. The next, I was staring at overdue bills, a drained bank account, and the weight of uncertainty pressing down on my shoulders. But in the chaos, I discovered one critical strategy that saved me: true asset diversification. It wasn’t about quick fixes or risky bets. It was a disciplined shift in how I viewed wealth, risk, and security. This is how I rebuilt—not just financially, but with lasting peace of mind.

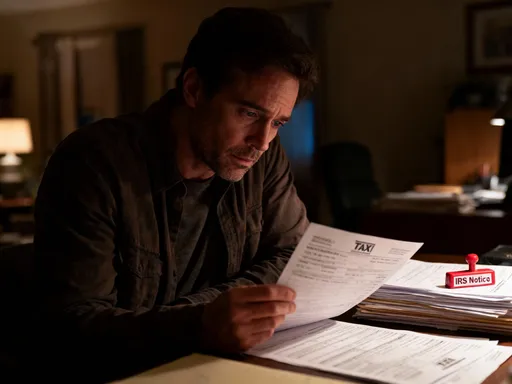

The Day Everything Fell Apart

The call came on a Tuesday morning. A major client—responsible for nearly 40 percent of my company’s annual revenue—was terminating our contract. No warning. No negotiation. Just a formal letter stating that their strategic direction had changed. At first, I thought we could recover. We had other clients, after all. But within weeks, the domino effect began. Suppliers tightened credit terms. Employees, sensing instability, began to leave. I dipped into personal savings to cover payroll, convincing myself that the next big deal would close soon. It didn’t. By the third quarter, cash flow had completely stalled. I made the hardest decision of my professional life: I filed for business dissolution.

The emotional toll was overwhelming. For years, my identity had been tied to the company. I had poured my time, energy, and self-worth into building something meaningful. When it collapsed, I felt not just financially exposed, but personally defeated. The financial impact was equally severe. My retirement accounts were underfunded, my emergency fund had been exhausted, and most of my net worth was locked in business assets that no longer had value. I had no passive income. No real estate. No diversified investments. Everything rested on one fragile foundation—and when that foundation cracked, the entire structure came down with it.

Looking back, I realize how common my story is. Many entrepreneurs and small business owners operate under the illusion of stability. As long as revenue is coming in, it’s easy to believe that success is permanent. But the truth is, no single business is immune to disruption. Market changes, economic downturns, shifts in consumer behavior—any of these can dismantle even the most promising ventures. My experience wasn’t unique. It was a warning. And the most painful lesson was this: financial security cannot be built on a single source of income, no matter how successful it appears.

Why Relying on One Business Is a Silent Risk

At the heart of my downfall was a fundamental flaw in my financial strategy: overconcentration. Like many business owners, I believed that reinvesting all profits back into the business was the smartest path to growth. I thought that scaling operations, hiring more staff, and expanding services would naturally lead to greater wealth. What I failed to see was that I was also concentrating risk. Every dollar I earned, saved, or reinvested was tied directly to the performance of one entity—one idea, one market, one customer base. That made me vulnerable in ways I didn’t understand until it was too late.

Financial experts often use the analogy of eggs and baskets for a reason. If you place every egg in a single basket and that basket falls, you lose everything. Diversification is the practice of distributing those eggs across multiple baskets—some sturdy, some flexible, some designed for different environments. In financial terms, this means spreading investments across different asset classes, industries, and geographic regions to reduce exposure to any single point of failure. When one area underperforms, others may hold steady or even gain value, helping to stabilize the overall portfolio.

But beyond the metaphor, there are concrete risks to relying solely on a business for wealth creation. First is market volatility. No industry is immune to change. Technological innovation, regulatory shifts, or new competitors can render a once-thriving business model obsolete almost overnight. Second is customer dependency. Relying heavily on a small number of clients, as I did, creates a dangerous imbalance. If even one major client leaves, revenue can plummet before alternatives are found. Third is operational risk—the possibility of internal failures, such as mismanagement, supply chain issues, or legal disputes. These factors don’t always signal immediate danger, but they accumulate quietly, like cracks in a foundation, until the structure finally gives way.

Perhaps the most insidious aspect of single-business reliance is the false sense of control it creates. When a business is doing well, owners often feel they are in complete command of their financial destiny. But that control is largely illusory. External forces—economic cycles, public health crises, geopolitical events—can disrupt even the best-run companies. True financial resilience doesn’t come from controlling every variable. It comes from accepting uncertainty and building systems that can withstand it. That realization didn’t come to me in the early days of success. It came in the silence that followed the collapse—when I had nothing left but time to reflect on what went wrong.

The Wake-Up Call: Learning from My Mistake

In the months after the business closed, I didn’t immediately turn to finance books or investment advisors. I was too overwhelmed, too ashamed. But eventually, curiosity replaced despair. I began asking questions: How do people protect their wealth? What do financially secure families do differently? I started reading about personal finance, not as abstract theory, but as survival strategy. What I discovered changed my perspective completely. Wealth isn’t just about earning more. It’s about protecting what you have and allowing it to grow in ways that don’t depend on your constant effort.

One concept kept appearing in every credible resource: asset diversification. At first, it sounded like generic advice—the kind of thing people say without really explaining. But as I dug deeper, I realized it was far more powerful than I had assumed. Diversification isn’t just about owning different things. It’s about creating a financial ecosystem where different components serve different purposes. Some assets generate income. Others preserve capital. Some grow slowly but steadily. Others offer liquidity for emergencies. Together, they form a buffer against uncertainty.

The real turning point was a shift in mindset. For years, I had equated financial success with business growth. More clients, higher revenue, bigger offices—that was my definition of progress. But after the collapse, I began to value stability over speed, balance over scale, and protection over expansion. I stopped asking, “How can I make more money?” and started asking, “How can I keep what I have and let it grow safely?” That mental shift was the foundation of my recovery. It allowed me to approach money not as a tool for immediate gratification or status, but as a means of long-term security and freedom.

This new perspective didn’t erase the pain of failure, but it gave it meaning. I began to see my experience not as a personal flaw, but as a necessary lesson—one that could guide better decisions moving forward. I realized that financial resilience isn’t built in moments of crisis. It’s built quietly, over time, through consistent choices that prioritize sustainability over spectacle. And the most important choice I made was to stop relying on a single source of income and start building a diversified foundation for the future.

What Asset Diversification Really Means (And What It Doesn’t)

Despite how often it’s mentioned, asset diversification is frequently misunderstood. Many people think it means owning a little bit of everything—stocks, real estate, gold, maybe a side business. But true diversification isn’t about quantity. It’s about quality of allocation. It’s about structuring your portfolio so that different assets respond differently to market conditions. When one asset class declines, another may remain stable or rise, reducing the overall impact on your net worth.

At its core, asset diversification involves spreading investments across several major categories. The first is **equities**, or stocks. These represent ownership in companies and offer the potential for long-term growth. Historically, stock markets have delivered strong returns over decades, but they come with volatility. Prices can swing dramatically in short periods, making them unsuitable as a sole investment.

The second category is **fixed income**, such as bonds or certificates of deposit. These are generally more stable than stocks and provide regular interest payments. While they offer lower returns, they serve as a ballast in a portfolio, helping to offset the ups and downs of riskier assets. The third category is **real estate**, which can generate rental income and appreciate in value over time. Unlike stocks, real estate is a tangible asset, and its performance often follows different economic cycles.

The fourth category is **cash and cash equivalents**, such as savings accounts, money market funds, or short-term Treasury bills. These are the most liquid and secure assets, essential for emergencies and short-term needs. While they earn minimal returns, their primary role is preservation, not growth. Finally, some investors include **alternative investments**, such as private equity, commodities, or infrastructure funds. These can add further diversification but often require higher knowledge, longer time horizons, or greater capital.

What diversification is not is a guarantee against loss. No strategy can eliminate risk entirely. Nor is it about chasing every new investment trend. Buying multiple stocks in the same industry, for example, does not count as true diversification—because they are likely to be affected by the same market forces. True diversification requires intentionality. It means understanding how different assets behave under various conditions and combining them in a way that aligns with your risk tolerance, time horizon, and financial goals. It’s not about avoiding risk altogether. It’s about managing it wisely.

Building a Resilient Portfolio: My Step-by-Step Shift

After understanding the principles of diversification, I began the slow process of rebuilding. I didn’t make drastic changes overnight. Instead, I took a methodical approach, guided by three principles: start small, prioritize safety, and seek professional advice. My first step was to assess my remaining assets. I had some personal savings, a modest retirement account, and the equity in my home. None of these were tied to the failed business, which gave me a foundation to build on.

I began by establishing a stronger emergency fund—six months’ worth of living expenses in a high-yield savings account. This wasn’t an investment for growth. It was a safety net, designed to prevent future financial shocks from forcing me into debt or premature withdrawals from long-term accounts. With that in place, I turned to my retirement portfolio. I worked with a certified financial planner to rebalance my 401(k) and IRA accounts. We shifted from a stock-heavy allocation to a more balanced mix of equities, bonds, and index funds, tailored to my age and risk tolerance.

Next, I began investing in real estate—not by buying a rental property outright, but through a real estate investment trust (REIT). REITs allow individuals to earn income from property without the responsibilities of direct ownership. They are traded like stocks but offer exposure to commercial and residential real estate markets. This added a new asset class to my portfolio without requiring a large upfront investment or management effort.

I also started dollar-cost averaging into low-cost index funds. Instead of trying to time the market, I invested a fixed amount each month, regardless of market conditions. This strategy reduced the impact of volatility and allowed me to accumulate shares over time at different price points. It wasn’t exciting. There were no sudden gains or headlines. But it was consistent, disciplined, and aligned with long-term growth.

One of the most important decisions was to stop viewing my income as something to be fully reinvested. I now allocate a portion of every paycheck to different buckets: one for expenses, one for savings, one for investments, and one for personal development. This system ensures that growth doesn’t come at the expense of stability. It also makes financial progress measurable and sustainable. The transformation wasn’t dramatic, but it was real. Year after year, my net worth grew—not because of a single windfall, but because of consistent, diversified effort.

Balancing Risk and Return Without Gambling

One of the biggest fears people have about investing is risk. They imagine the stock market as a casino, where fortunes are won or lost overnight. But responsible investing isn’t about gambling. It’s about managing risk through informed decisions and balanced allocation. Diversification is the key to this balance. By holding a mix of assets, investors can reduce the impact of any single loss while still participating in long-term growth.

Historical data supports this approach. Over the past 90 years, a portfolio consisting solely of U.S. stocks has delivered an average annual return of about 10 percent. But it has also experienced significant downturns—like the 50 percent drop during the 2008 financial crisis. In contrast, a balanced portfolio of 60 percent stocks and 40 percent bonds has delivered slightly lower returns—around 8 to 9 percent annually—but with much less volatility. The difference may seem small, but over decades, it translates into more predictable growth and fewer sleepless nights.

Another important concept is correlation. When two assets are highly correlated, they tend to move in the same direction at the same time. For example, most technology stocks tend to rise and fall together. True diversification seeks to include assets with low or negative correlation—meaning when one goes down, the other may stay flat or go up. This is why combining stocks, bonds, and real estate can be more effective than owning multiple types of stocks alone.

Rebalancing is another essential practice. Over time, some assets grow faster than others, shifting the original balance of a portfolio. For example, if stocks perform well, they may come to represent 70 percent of a portfolio that was originally set at 60 percent. Rebalancing means selling some of the outperforming assets and buying more of the underperforming ones to restore the target allocation. This enforces discipline—buying low and selling high—and helps maintain the desired level of risk.

Patience is just as important as strategy. Wealth built through diversification doesn’t happen overnight. It grows gradually, like a tree. There will be storms. There will be seasons of slow growth. But with a strong root system—diverse, balanced, and well-maintained—the tree endures. I’ve learned to stop measuring success by short-term gains and start focusing on long-term stability. That shift has brought not just financial peace, but emotional peace as well.

Lessons That Last: Turning Failure into Financial Clarity

The collapse of my business was one of the hardest experiences of my life. But it was also one of the most transformative. It forced me to confront my assumptions about money, work, and security. I used to believe that success meant building something big. Now I know that true success means building something sustainable. The most valuable asset I have today isn’t a property or a stock portfolio. It’s clarity—the understanding that financial peace comes not from income alone, but from structure, discipline, and foresight.

I’ve also learned that resilience is not the absence of failure. It’s the ability to recover, adapt, and grow stronger. That requires preparation. It means making smart choices when times are good, not just when they’re bad. It means accepting that uncertainty is part of life—and building a financial plan that can withstand it. I now view my money not as a number to be maximized, but as a tool to create freedom, security, and opportunity.

If there’s one message I could share with others, it’s this: start small, but start now. You don’t need a fortune to begin diversifying. You need a plan, a commitment, and the willingness to learn. Open a separate savings account. Contribute regularly to a retirement fund. Explore low-cost index funds or REITs. Talk to a financial advisor. Every step, no matter how small, moves you further from dependency and closer to independence.

My journey wasn’t about getting rich quickly. It was about building a future that couldn’t be shattered by a single event. I no longer measure my worth by the size of my business or the size of my bank account. I measure it by my peace of mind, my ability to handle the unexpected, and the quiet confidence that comes from knowing I am prepared. That, more than any dollar amount, is the true definition of financial security.