How I Navigated Sudden Illness Without Financial Disaster — Market-Smart Moves That Saved Me

A sudden illness hit me out of nowhere — and nearly wiped out my savings. I felt overwhelmed, not just by health worries, but by medical bills and lost income. That’s when I realized my finances weren’t built for emergencies. But instead of collapsing, I adapted. By aligning my money moves with real market trends and practical safeguards, I protected what I had and even grew stability. This is how I turned crisis into control — and how you can too, before life throws its next curveball.

The Wake-Up Call: When Health Shocks Your Wallet

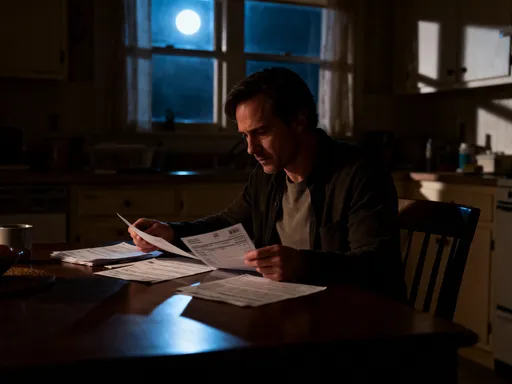

It started with a sharp pain in my side that wouldn’t go away. Within 48 hours, I was in the emergency room, diagnosed with a serious condition requiring immediate treatment. The diagnosis was frightening, but what followed was just as jarring: the realization that my financial safety net was thinner than I’d ever imagined. I had health insurance, yes, but it didn’t cover everything. Co-pays, specialist visits, prescription medications, and follow-up tests quickly added up. On top of that, I couldn’t work for nearly three months. My income dropped to zero, but my expenses didn’t. Rent, utilities, groceries — they all kept coming due. I watched my savings account dwindle with each passing week, and the stress began to feel as consuming as the illness itself.

This experience opened my eyes to a reality many of us ignore: financial fragility in the face of health crises is far more common than we admit. Most people believe they’re prepared until they’re not. A 2023 Federal Reserve report found that nearly 30% of Americans would struggle to cover an unexpected $500 expense. For a medical emergency, which can easily cost thousands, that number climbs even higher. The danger isn’t just the illness — it’s the financial domino effect that follows. Missed payments lead to late fees, which damage credit, which makes future borrowing more expensive. The emotional toll compounds everything, making clear-headed decisions nearly impossible when they’re needed most.

What made my situation even more complex was the economic backdrop. Interest rates were rising, inflation was eroding purchasing power, and investment markets were volatile. These weren’t just abstract trends — they directly impacted my ability to respond. High inflation meant everyday costs were climbing while my income was frozen. Rising interest rates made borrowing more expensive if I needed a loan. And market swings threatened the value of the investments I’d hoped would grow quietly in the background. I began to see that financial resilience isn’t just about how much you save — it’s about how your money is structured to withstand real-world shocks, especially when you’re too unwell to manage it actively.

Emergency Funds in a Shifting Economy: More Than Just Cash

Like many people, I once believed that an emergency fund simply meant keeping three to six months’ worth of expenses in a regular savings account. I followed that advice — until I realized it wasn’t enough. When inflation was running at over 5% annually, the money I’d saved was quietly losing value. A dollar saved a year earlier bought less today, even though it was still technically the same amount. My emergency fund wasn’t just sitting idle — it was eroding. That’s when I learned a crucial lesson: in today’s economy, cash alone isn’t safety. True emergency preparedness means protecting both liquidity and purchasing power.

I began researching better ways to hold emergency funds — accounts that offered safety but also kept pace with inflation. High-yield savings accounts emerged as a practical solution. Unlike traditional banks that offer minimal interest, some online banks and credit unions provide rates that adjust with the broader interest rate environment. At the time, I found options offering over 4% annual yield, which wasn’t beating inflation completely but was significantly better than the 0.01% I was earning before. The key was ensuring the account remained FDIC-insured and fully accessible, so I wouldn’t sacrifice security for return. I also explored short-term certificates of deposit (CDs) with no penalties for early withdrawal, allowing me to earn slightly higher interest while maintaining flexibility.

Another strategy I adopted was staggering my emergency reserves across multiple time horizons. I divided my fund into three parts: one portion in a highly liquid account for immediate needs, another in a 3-month CD for slightly higher yield, and a third in a money market fund that tracks short-term Treasury securities. This ladder approach reduced the risk of being locked into low rates while still keeping most of my money within reach. It also taught me an important principle: emergency funds shouldn’t be static. They need to respond to economic shifts just like any other financial tool. By aligning my cash reserves with market trends, I turned what was once a passive cushion into an active shield — one that could protect me without losing value while waiting.

Insurance That Actually Works: Beyond the Fine Print

During my recovery, I spent hours reviewing my insurance policies — not just health insurance, but disability and life coverage as well. I discovered gaps I hadn’t noticed before. My health plan had a high deductible, and certain treatments required prior authorization, causing delays. More troubling, I had no short-term disability insurance. That meant when I couldn’t work, no paycheck followed. I had assumed my employer’s benefits were sufficient, but they only covered a fraction of my income after a long waiting period. This was a costly oversight. Without income protection, even a well-managed emergency fund can be drained in weeks.

I decided to rebuild my insurance strategy with two goals: coverage that pays when I need it, and policies that adapt to changing economic conditions. I switched to a health plan with a lower deductible and better prescription coverage, even if the monthly premium was slightly higher. For long-term security, I added a private short-term disability policy that kicks in after just 30 days and covers up to 60% of my income. I also looked for policies with cost-of-living adjustments — features that increase benefits over time to keep pace with inflation. These aren’t standard in most plans, but they exist, and they make a critical difference when a disability lasts for months or years.

I also reviewed my life insurance and made sure it included a living benefit rider, which allows access to a portion of the death benefit if I’m diagnosed with a critical illness. This isn’t just for end-of-life planning — it’s a financial tool that can help cover expenses during recovery. The key lesson was to stop treating insurance as a set-it-and-forget-it expense. Policies need regular review, especially as income, family needs, and healthcare costs change. I now schedule an annual insurance check-up, just like a medical exam. By choosing coverage that aligns with real market trends — such as rising healthcare costs and longer recovery times — I’ve built a safety net that’s far more likely to hold when tested.

Investing Through Uncertainty: Protecting Assets When You Can’t Work

One of my greatest fears during illness was losing control of my investments. I had a modest portfolio of stocks and mutual funds, but I wasn’t in a state of mind to monitor the markets. I worried about making impulsive decisions — selling low out of fear, or missing opportunities because I was too distracted to act. The truth is, health crises often coincide with market volatility. Economic uncertainty, inflation spikes, and geopolitical tensions can all drive swings in asset prices. When you’re already under physical and emotional strain, the last thing you need is financial whiplash.

To protect my investments, I restructured my portfolio around stability and automation. I shifted toward a more diversified mix, emphasizing defensive assets like dividend-paying stocks, investment-grade bonds, and real estate investment trusts (REITs). These assets tend to be less volatile than growth stocks and can provide steady income even in downturns. I also adopted a core-satellite approach: a large portion in low-cost index funds that track broad market performance, with smaller allocations to targeted sectors based on long-term trends. This reduced my exposure to any single market shock while maintaining growth potential.

Equally important was setting up automatic rebalancing. I worked with a financial advisor to establish rules that would adjust my asset allocation if markets moved too far in one direction. For example, if stocks rose to more than 65% of my portfolio, a certain percentage would automatically shift to bonds to maintain balance. This removed emotion from the equation and ensured my strategy stayed on track, even when I couldn’t manage it myself. I also designated a trusted family member as my financial power of attorney, with clear instructions on how to handle accounts if I became incapacitated. These steps didn’t guarantee profits, but they provided peace of mind — knowing my financial foundation wouldn’t collapse just because I was too unwell to maintain it.

Passive Income as a Safety Net: Building Streams That Work for You

One of the most empowering changes I made was shifting from relying solely on active income to building multiple sources of passive cash flow. Before my illness, nearly all my money came from my job. When that stopped, everything stopped. That experience taught me that true financial security means having income that continues even when you can’t work. Passive income isn’t about getting rich — it’s about creating a buffer that keeps the lights on when life interrupts your ability to earn.

I started small. I invested in dividend-paying exchange-traded funds (ETFs) that distribute earnings quarterly. These funds hold baskets of established companies with a history of consistent payouts, such as utilities, consumer staples, and healthcare providers. Even during market dips, many of these companies continued to pay dividends, providing a steady trickle of income. I also explored real estate, not by buying a full property, but through real estate crowdfunding platforms that allow fractional ownership in rental properties. These platforms pool investor funds to purchase homes or apartment buildings, then distribute rental income based on ownership share. The returns aren’t huge — typically 4% to 7% annually — but they’re consistent and require no daily management.

Another avenue I pursued was digital assets, such as creating an online course based on my professional skills. Once developed, it generates sales with minimal ongoing effort. While this required upfront time, it’s now a source of recurring revenue that doesn’t depend on my physical presence. I also reinvested a portion of my passive income into low-maintenance assets, creating a compounding effect over time. The lesson here is that passive income doesn’t require large capital or risky bets. It’s about identifying realistic opportunities that align with current market behaviors — such as steady demand for housing or consumer goods — and building systems that work quietly in the background. When illness struck again — a minor flare-up months later — I didn’t panic. My passive streams kept flowing, and I had breathing room to focus on healing.

Debt Management in Crisis: Avoiding the Spiral

One of the most dangerous aspects of a health crisis is how quickly it can trigger a debt spiral. With no income and mounting bills, it’s tempting to rely on credit cards or personal loans. I saw this happen to a friend who charged medical expenses to a high-interest card, only to find the balance ballooning with interest. Within a year, a $5,000 expense grew to over $7,000. I was determined not to follow that path. I knew that in a rising interest rate environment, new debt becomes more expensive, and existing debt becomes harder to manage. The key wasn’t just avoiding debt — it was managing it wisely before a crisis hit.

I began by reviewing all my existing debts. I consolidated high-interest credit card balances into a lower-rate personal loan with a fixed payment schedule. This reduced my monthly outflow and locked in a predictable rate before lenders raised prices further. I also contacted my mortgage servicer to inquire about forbearance options, not because I needed them yet, but to understand my rights and timelines. Many lenders offer temporary relief programs for borrowers facing medical hardship, but you have to ask — and often, you need documentation ready in advance.

I also built a debt management plan as part of my overall financial strategy. I set a strict rule: no new debt for non-essential expenses. I prioritized paying down high-interest balances first while maintaining minimum payments on others. I used windfalls — tax refunds, bonuses, or passive income — to accelerate payoff. Most importantly, I created a crisis budget that outlined exactly which bills could be paused or reduced if income stopped. Utilities often offer payment assistance, and some service providers allow temporary freezes. By planning ahead, I turned debt from a potential trap into a manageable part of my financial picture. When illness returned, I didn’t reach for my credit card. I followed my plan — and stayed out of the spiral.

Putting It All Together: A Resilient Financial Mindset

Looking back, I realize that surviving a health crisis wasn’t just about medical treatment — it was about financial resilience. The tools that saved me weren’t complex or flashy. They were practical, grounded in real-world conditions, and designed to work even when I couldn’t. I learned that financial security isn’t about predicting the future — it’s about preparing for uncertainty. It’s not about earning more, but about structuring what you have to withstand shocks. And it’s not about perfection — it’s about progress, one smart decision at a time.

Today, my finances reflect a system, not a collection of isolated choices. My emergency fund earns interest while staying accessible. My insurance covers real risks, not just paperwork. My investments are diversified and automated. My income isn’t tied to a single job. And my debt is managed, not feared. These elements work together, creating a web of protection that adapts to changing markets and personal circumstances. I no longer worry about a single setback wiping me out. I know I’m not invincible — but I am prepared.

My hope is that my story offers more than caution — it offers clarity. You don’t need a perfect financial plan to be safe. You need awareness, intention, and the courage to act before crisis strikes. Start where you are. Review your emergency fund. Check your insurance. Explore one new source of passive income. These steps won’t make you rich, but they can keep you in control. And that, more than anything, is the foundation of true peace of mind. Life will throw curveballs. But with the right preparation, you can catch them — and keep moving forward.